Global Stock Market Valuations January 2023

Where to find cheap stocks and high dividends? Check 25 markets worldwide

Research has consistently shown that the best time to buy stocks is when prices are low compared to valuation metrics.

I use a global valuation model which I first evaluated in 2001 for a large Dutch Asset Manager and further developed the last few years. The model shows whether or not stock markets are under or overvalued relative to historic measures. And how they compare to other stock markets. The goal is to find profitable investment opportunities. In my newsletter, The Global Value Report, I share my findings and insights.

For Stock Market Valuations I use MSCI index data and benchmark measures from Schroders. Historical Cape ratios are from Barclays (per 30-12-2022).

How I use this model

For monthly investment decisions I check Core Market valuations for long term investments to buy and hold ETF’s at least 10 years. Core markets are the US, Europe and Emerging Markets.

If I can’t find opportunities to invest I look further to cheap emerging markets like China A, Turkey and Korea, which I sell when they are fairly valued or increased more than 40% in price. This model is purely quantitative and I check the largest positions before buying. Using this model last month I sold two thirds of my Turkey ETF’s, which are still cheap but increased 91% in value last year. And bought iShares Europe ETF’s.

Besides using this model I use dollar-cost-averaging to buy US and World ETF’s for the same amount of money every month. And I buy cheap and undervalued stocks.

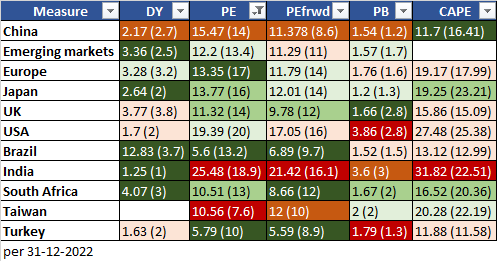

Valuation in camparison with historical measures

Japan, Europe, UK and Emerging Markets are undervalued compared to historical measures (15 year median). Chinese stocks are quite expensive. Stocks in the United States are slightly overvalued.

Stocks in the UK offer with 3,77% the highest dividend yield in Core markets.

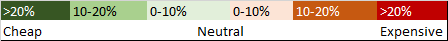

Global Market Valuations

Stocks in India, The Netherlands and US growth stocks are expensive. You find the cheapest stocks in Brazil, Turkey, Korea and Italy.

Korea, Taiwan, China and USA Growth were the worst performing markets last year. Turkey and Brazil the best performing. Last year 22 of the 25 markets had a negative return which makes 2022 one of the worst years for stock investors. The good news that there are a lot more investment opportunities than the last few years.

Dividend yield

Brazilian stocks offer an extremly high dividend yield of 12,8%. Most investors doubt if this yield is sustainable.

Dividend investors find attractieve yields in the UK, Taiwan, Italy and Australia.

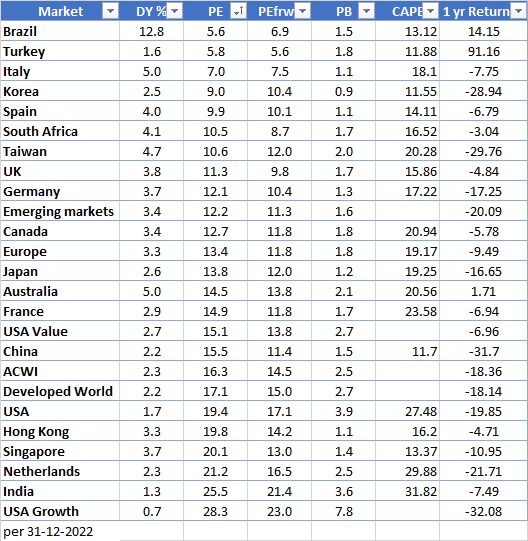

Price earnings ratio

Brazil, Turkey and Italy have the lowest price-earnings ratios of the 25 markets in the valuation model. Turkey seems cheap but appreciated 91% last year, dividend is low and inflation sky high (64%).

Most investors are pessimistic about Brazil and Turkey and therefor have low PE ratios.

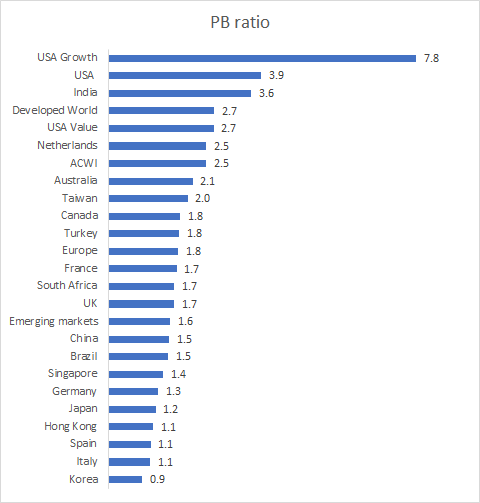

Price to book ratio

CAPE Ratio

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author.

Bronkhorst Media is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

The information contained on this website is not and should not be construed as investment advice. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own investigation and decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.