ETF in Focus: South Korea ETF

South Korean stocks top 'rebound candidate' for 2023. One of the cheapest markets in Asia.

Goldman Sachs said South Korean stocks are the top 'rebound candidate' for 2023 due to low valuations and a cheaper Won. Korean stocks have been recovering the last three months, but valuations are still low.

South Korea ETFs

Franklin and iShares offer a South Korea ETF. Both offer dividend. The Franklin FTSE South Korea ETF has the lowest expense ratio: 0.09%. This fund has 160 positions.

iShares MSCI South Korea ETF gives exposure to 103 large and mid-sized companies in South Korea. Companies like Samsung, Hyundai and Kia. The expense ratio is high with 0.58%.

Franklin FTSE South Korea ETF - expense ratio: 0.09%

iShares MSCI South Korea ETF - expense ratio: 0.58%

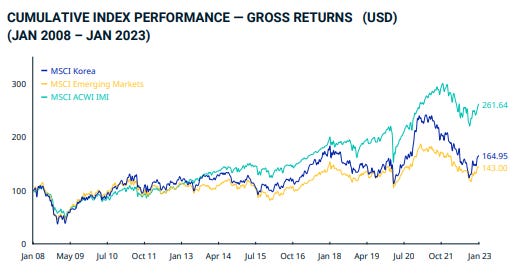

Performance

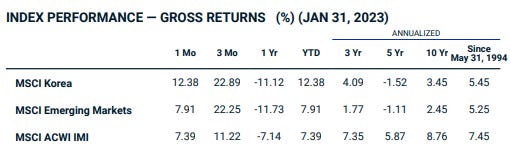

Korean stocks performed very wel in the 2000’s but the last 10 year they are lagging the US and Europe. The market is very volatile and dropped -28.94% in 2022. Last year the Korean stock market was one of the worst performing markets worldwide. The last 3 months Korean stocks had a strong rebound, but valuations are still low.

Valuation

Due to the large price drop in 2022, Korean stocks were among the lowest valued in the world and much cheaper than Emerging Markets and China. But dividend yields are low for Korean companies.

Current valuations:

Even with the strong performance of the last months Korea is still one of the cheapest markets in Asia.

Franklin FTSE South Korea ETF has a P/E ratio of 9.25, a P/BV 0,89.

iShares MSCI South Korea ETF has a P/E ratio of 7,89, a P/BV 0,99 and a dividend yield of 1.23%.

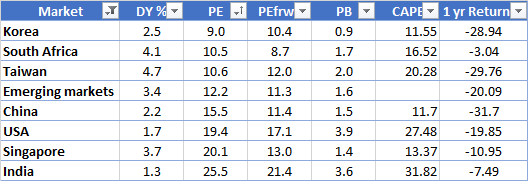

Holdings

Information technology has the largest sector weight with 32.85%. The rest is quite diverse across industries.

Samsung is by far the largest company in Korea, but the weight is capped to 21.79% by iShares and 16% by Franklin.

Largest positions iShares MSCI South Korea ETF (Name / Weight (%) )

SAMSUNG ELECTRONICS LTD - 21.79

SK HYNIX INC - 5.13

SAMSUNG SDI LTD - 4.05

LG CHEM LTD - 3.34

NAVER CORP - 2.73

POSCO - 2.54

HYUNDAI MOTOR - 2.46

KB FINANCIAL GROUP INC - 2.36

SHINHAN FINANCIAL GROUP LTD - 2.07

KIA CORPORATION CORP - 1.96

Risks

Korean stocks are known for the "Korea discount". The Korea discount refers, according to Reuters, to a tendency for South Korean companies to have lower valuations than global peers due to factors such as low dividend payouts, risks involving North Korea and the dominance of conglomerates.

Disclosure: I bought a South Korea ETF in January 2019 and sold in January 2021 with a price return of 55%. I might buy Korean ETF’s sooner or later.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. All opinions are my own. Not financial advice. Please consult your financial advisor before making any investment decision.