The best bond ETF's when rates are rising are short-term or floating rate bond ETF’s. These funds are less volatile than long-term bonds and you are more likely to benefit from rising interest rates. They provide current income while maintaining limited price volatility.

Both the FED and ECB have increased their rates this week. And further increases are expected to achieve an inflation at the rate of 2 percent over the longer run.

Where to invest in bonds and what to buy?

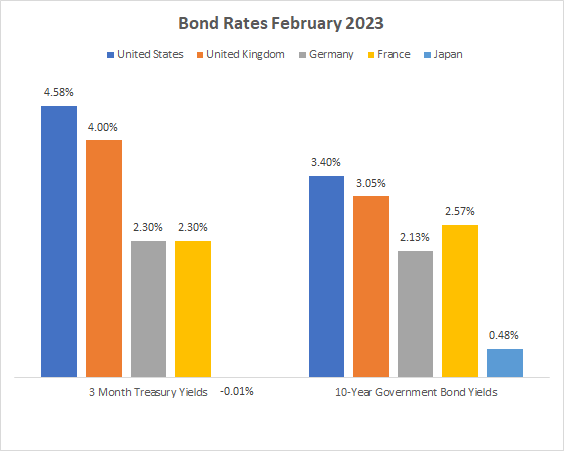

Bonds rates are much higher in the US than for most European countries.

And short term interest rates in the UK and US are higher then 10-Year Government Bond Yields. So you get a higher yield and less volatility with short term ETF’s.

Sources: OECD and Bloomberg

I did not choose inflation-protected U.S. Treasury bonds or inflation hedged ETF’s like iShares Inflation Hedged Corporate Bond ETF which lost-14.93% last year. Not a great inflation hedge. Same story for inflation-protected funds.

My selection of the best bond ETF’s for February 2023:

VanEck IG Floating Rate ETF

Expense ratio: 0.14%

Yield to Maturity: 5.49%

Coupon: 5.24%

3 YR annualized performance: 1.00%

I choose VanEck IG Floating Rate ETF because the potential to benefit from rising rates and high yield.

Floating rate notes are less sensitive to interest rate changes, but may decline in value if their interest rates do not rise as much or as quickly as interest rates in general (VanEck). Both Yield to Maturity (5.49%) and Coupon (5.24%) are high.

The portfolio is comprised of 175 corporate floating rate bonds from companies like Bank Of America, Goldman Sachs and Verizon. These rates are higher than government bonds. The weighted average maturity is 3.07 years. Last year’s performance was 0.68%.

In the US the yields are much higher than in Europe at this moment. 5.24% for VanEck IG Floating Rate ETF vs. 2.94% iShares € Floating Rate Bond ESG UCITS ETF (focus on Europe).

iShares Floating Rate Bond ETF

Expense ratio: 0.15%

Yield to Maturity: 5.26%

Coupon: 5.01%

3 YR annualized performance: 0.81%

iShares Floating Rate Bond ETF is a good alternative with access to 300+ shorter-term investment-grade bonds in a single fund. You get exposure to U.S. floating rate bonds, whose interest payments adjust to reflect changes in interest rates. The weighted average maturity is 1.64 years. Last year’s performance was 1.23%.

Credit Quality Exposure Breakdowns:

AAA Rated 17.51

AA Rated 12.64

A Rated 53.49

BBB Rated 13.85

Cash and/or Derivatives 2.51

iShares 0-3 Month Treasury Bond ETF

Expense ratio: 0.05%

Yield to Maturity: 4.43%

Coupon: 0.00%

1 YR annualized performance: 1.58%

iShares 0-3 Month Treasury Bond ETF gives exposure to U.S. Treasury bonds with remaining maturities less than or equal to three months. This is a money market bond fund, also known as ultra short bonds. Exposure Breakdown is 100% Cash and/or Derivatives.

WisdomTree Floating Rate Treasury Fund

Expense ratio: 0.15%

Yield to Maturity: 4.62%

Coupon: 4.55%

3 YR annualized performance: 0.81%

WisdomTree Floating Rate Treasury Fund seeks to track the price and yield performance of the Bloomberg U.S. Treasury Floating Rate Bond Index. Holdings consists of US Treasury which are 100% AAA quality. Average years to maturity are 1.5.

Vanguard Ultra-Short Bond ETF

Expense ratio: 0.10%

Yield to Maturity: 5.2%

Coupon: 3.0%

3 YR annualized performance: 0.65%

Vanguard Ultra-Short Bond ETF investment objective is to seek to provide current income while maintaining limited price volatility. The fund is designed to give investors low-cost exposure to money market instruments and short-term high-quality bonds, including asset-backed, government, and investment-grade corporate securities. This is more volatile than a money market fund. Average effective maturity is 0.9 years.

iShares Broad USD High Yield Corporate Bond ETF

Expense ratio: 0.15%

Yield to Maturity: 9.47%

Coupon: 5.80%

3 YR annualized performance: -0.40%

iShares Broad USD High Yield Corporate Bond ETF has a very high Yield to Maturity of 9.47%. But this fund is volatile and sensitive to interest rate increases. Last year the total return was -11,35%. The number of holdings is 1,936 with companies like Ford, CARNIVAL and OCCIDENTAL PETROLEUM. With the expected rate increases, I keep this ETF on my short list.

The last years I hardly invested in bonds. At first rates were to low for me. Last year most bond funds got a big blow due to increasing yields. But now there are finally interesting yields to provide income. Especially in de the US.